See Also: The Best Indicators for All Market Phases »

Submit your review | |

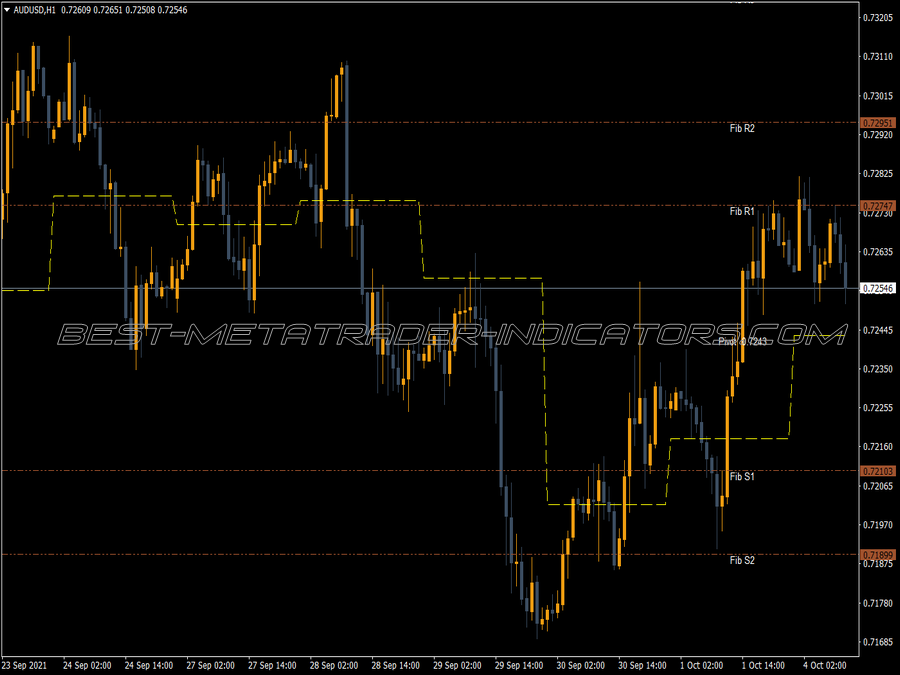

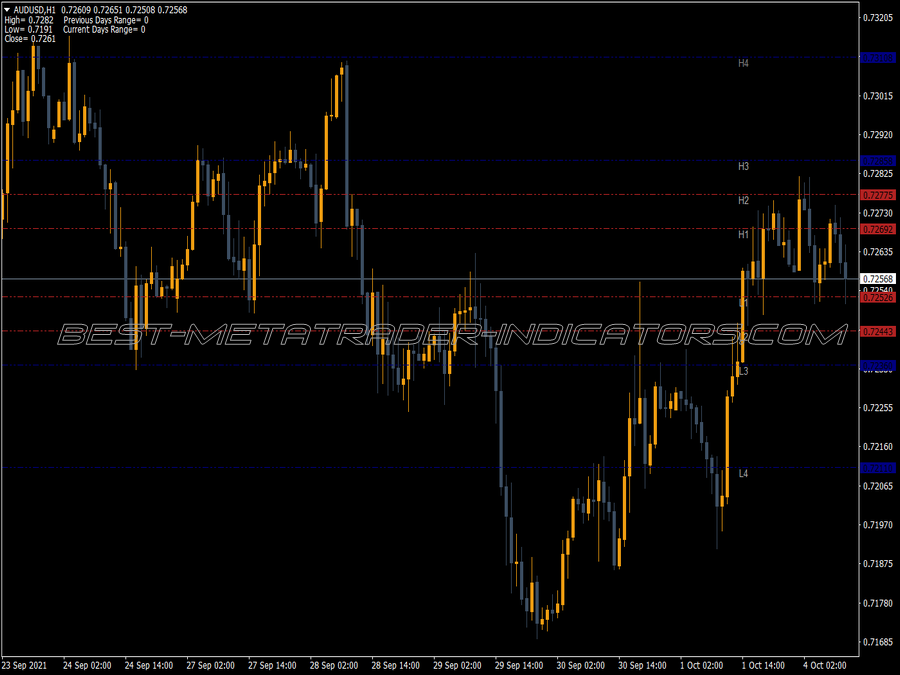

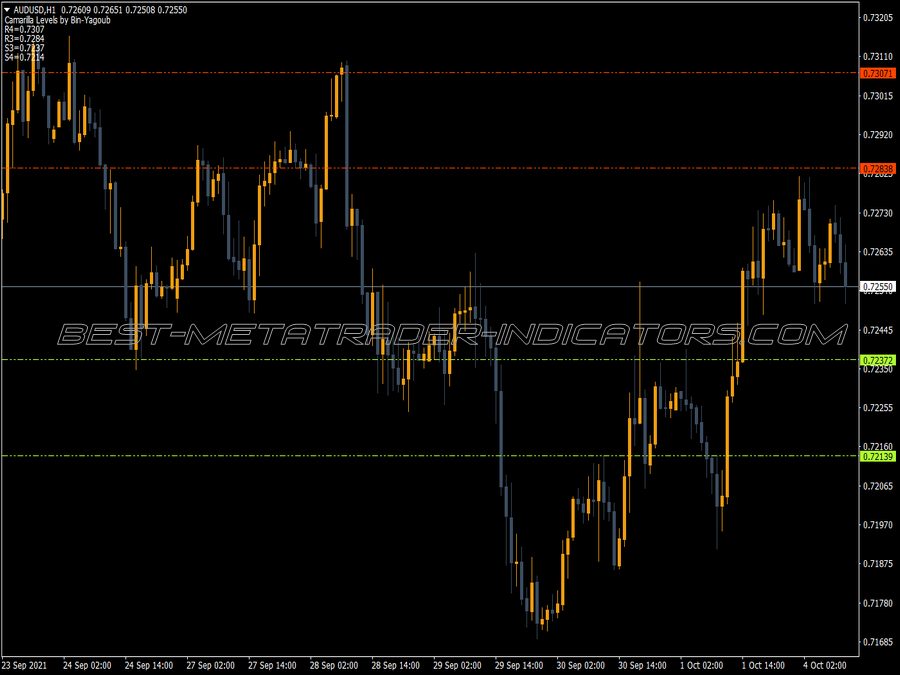

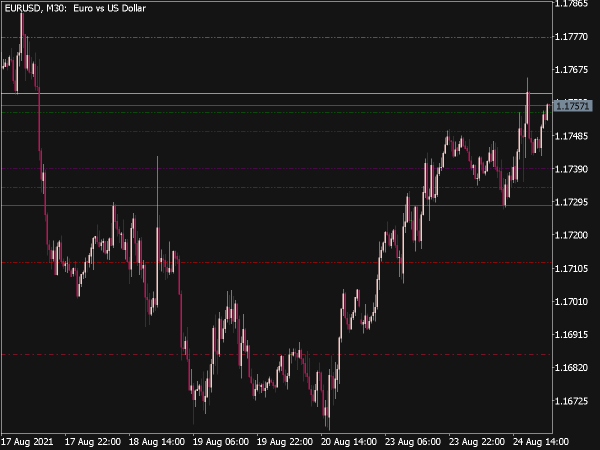

Camarilla Lines are derived from Camarilla equation. Nick Stott invented Camarilla equations while day trading in 1989. Camarilla lines are helpful for day trading as they give pivots based on yesterday's open, high, low and close.

Camarilla equation is based on the theory that markets have a tendency to revert to the mean. In simple words, when a pair has a considerably large distance between the high and low of the day before, it tends to reverse and retreat back towards the previous day's close, which means that today's intraday support and resistance can be predicted using yesterday's volatility.

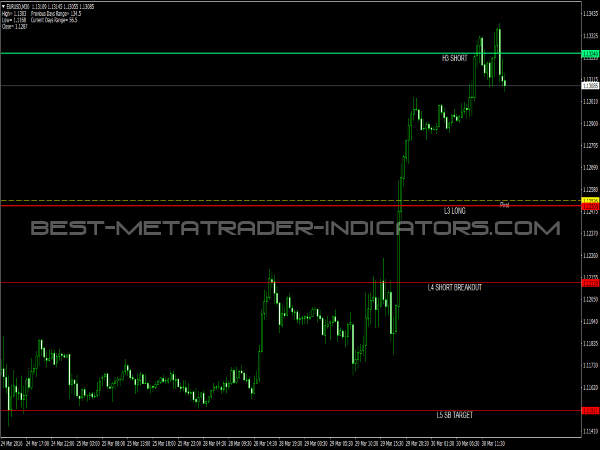

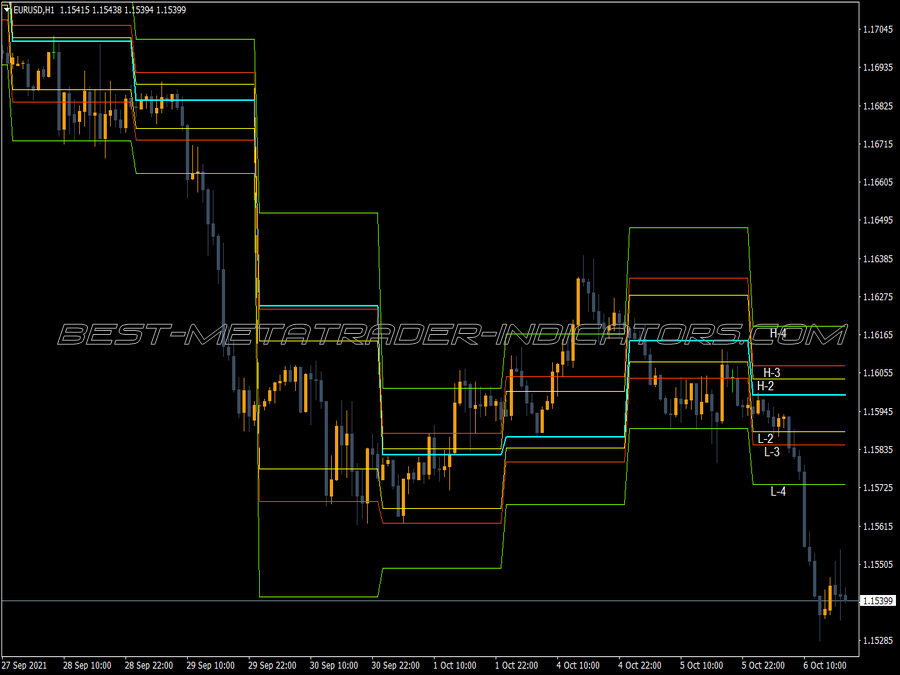

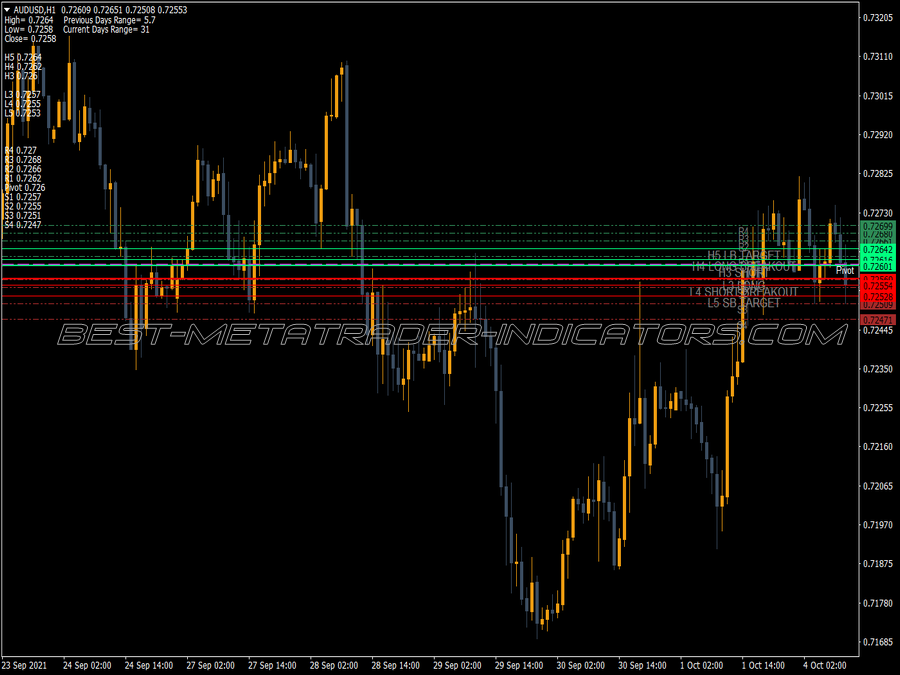

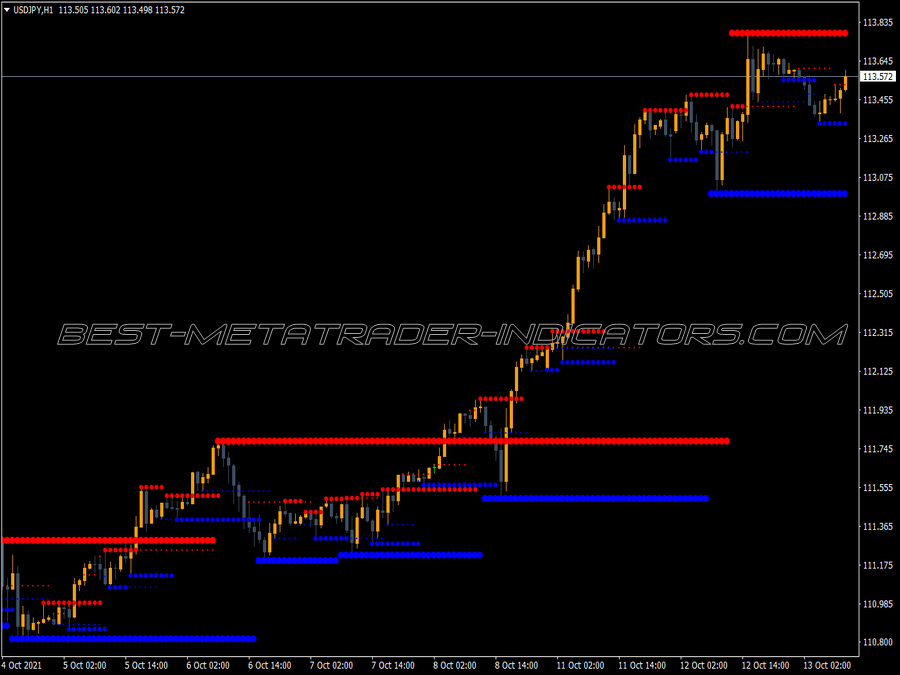

The Camarilla Equation produces 8 levels from yesterday's open, high, low and close. These levels are split into two groups, numbered 1 to 4. The pattern formed by the 8 levels is broadly symmetrical, and the most important levels are the "L3" and "L4" levels.

If open price is between H3 and L3, if we want to go long, then we will wait for the price to go below L3 and then when it moves back above L3, buy. Stop loss will be when price moves below L4. Target can be H1, H2 and H3 levels depending on the move's strength.

And if we want to go short, then we should wait for the price to go above H3 and then when the price moves back below H3, sell. Stop loss will be when price moves above H4. Target can be L1, L2 and L3 levels depending on the move's strength.

Now if open price is between H3 and H4, we can buy when price moves above H4. Stop loss when price goes below H3. And we can sell, when the price goes below H3. Stop should trigger when price moves above H4.

If the open price is between L3 and L4, we can go long when price moves above L3. Stop loss should be triggered when price moves below L4. And we can have a short sell when the price goes below L4. Stop loss when price moves above L3.

If the open price is outside the H4 and L4, we should wait for the price to come in range and trade accordingly.