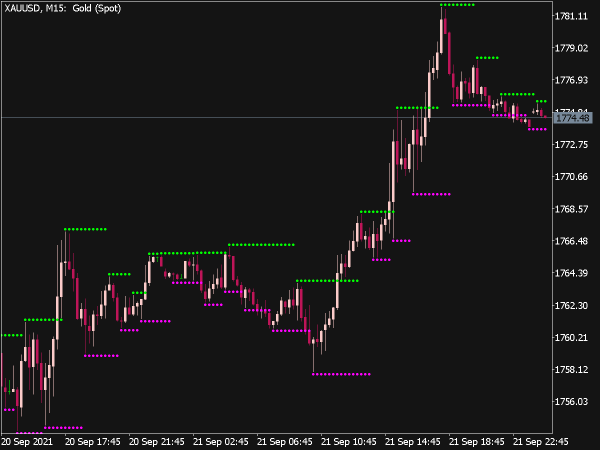

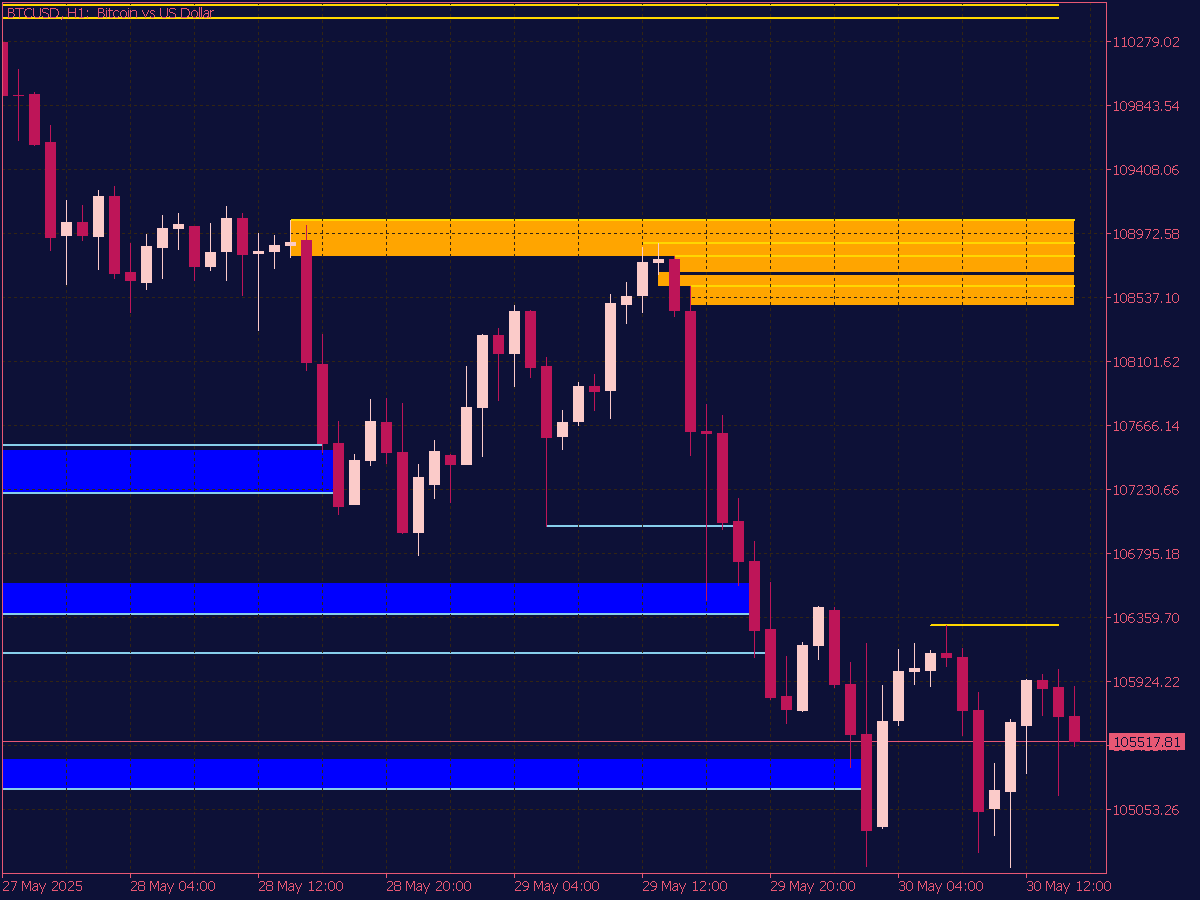

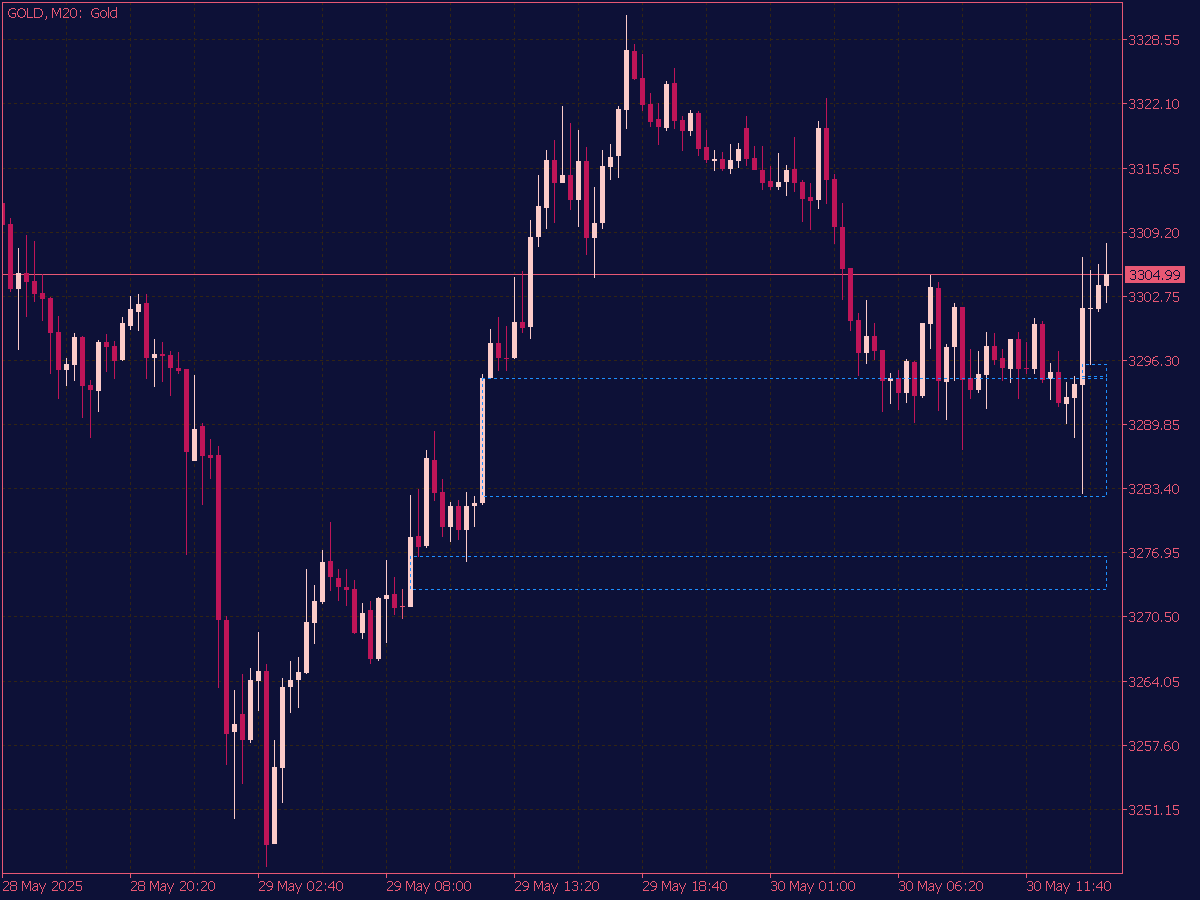

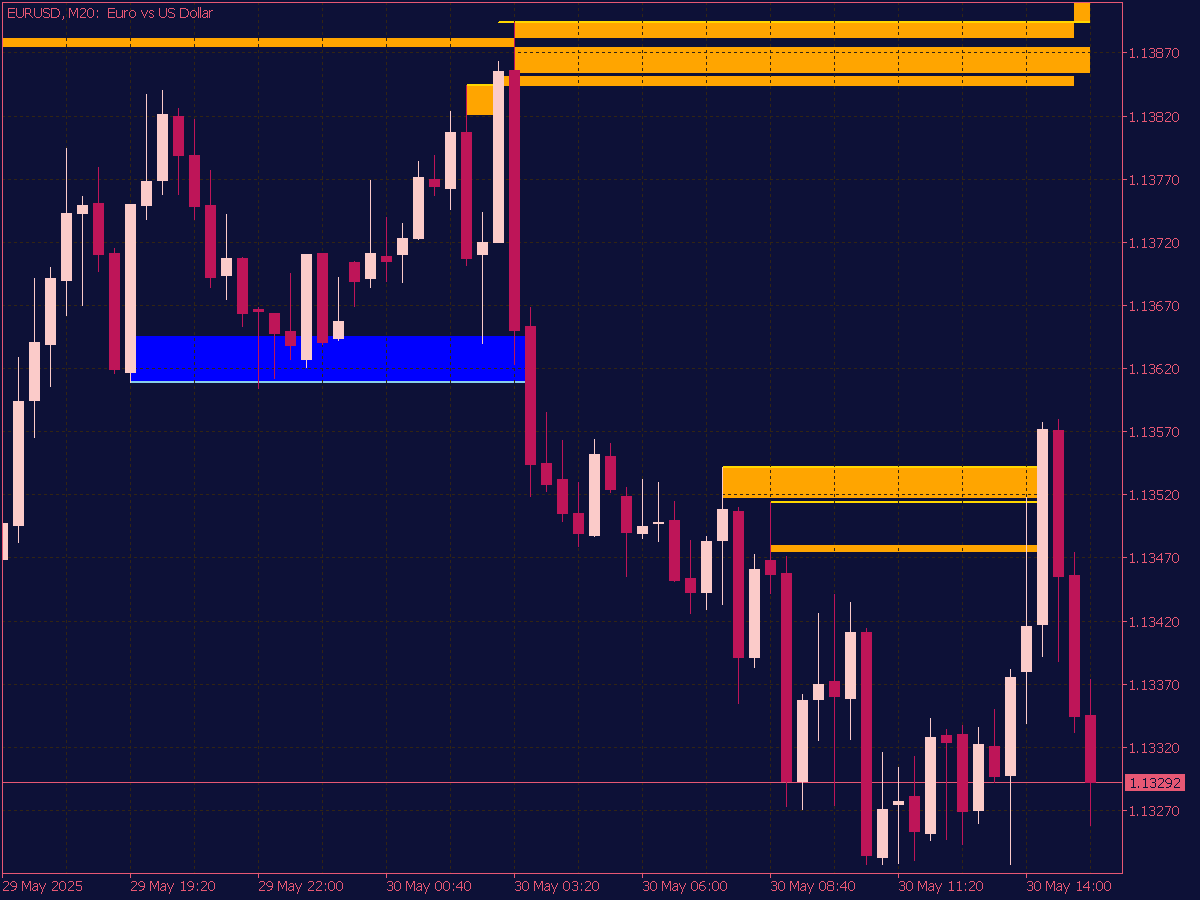

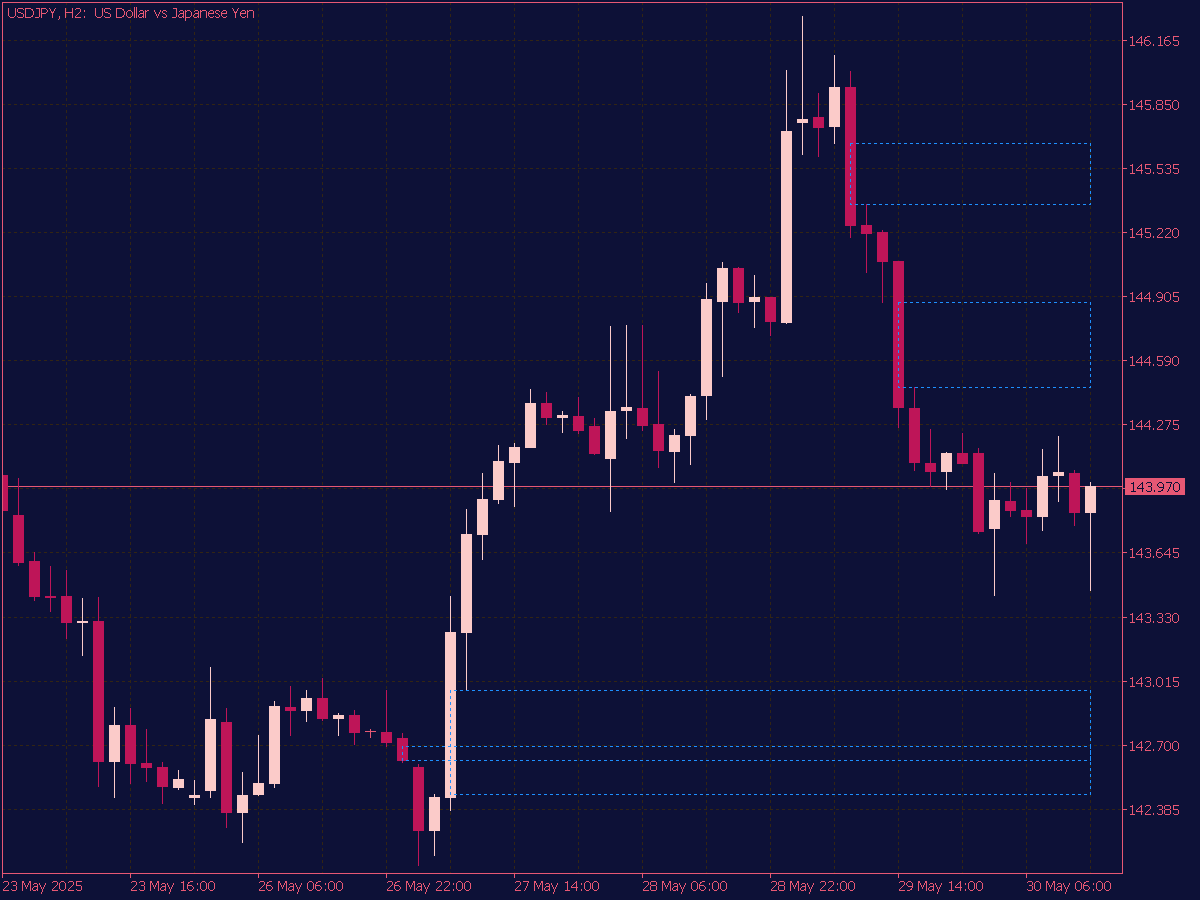

Fair Value Gap (FVG) trading is a concept often used in smart money and institutional trading strategies, particularly within price action-based systems. Fair Value Gaps represent inefficiencies in the market where price has moved rapidly, leaving a “gap” that often attracts a return move to fill that inefficiency. These gaps are visible on candlestick charts and usually span from the high of one candle to the low of the next after a large impulse move.

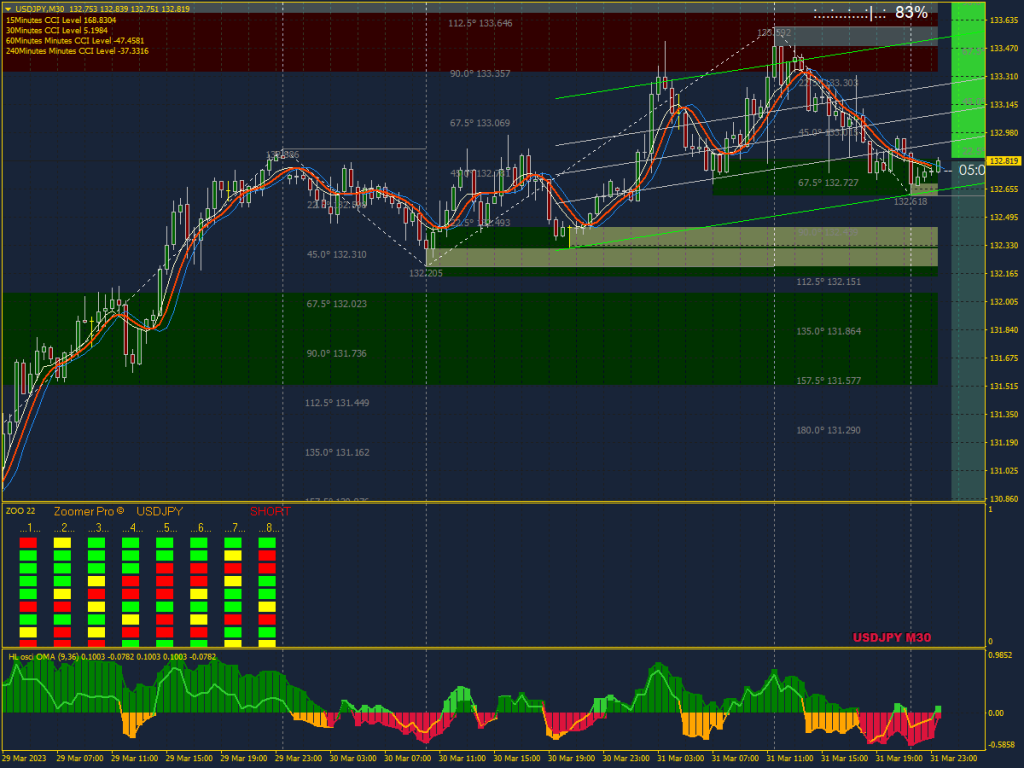

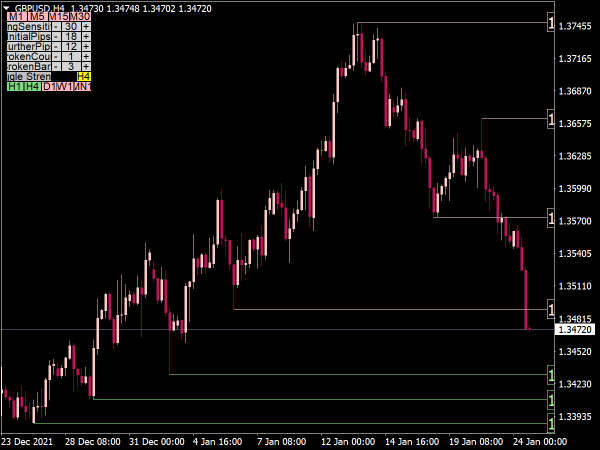

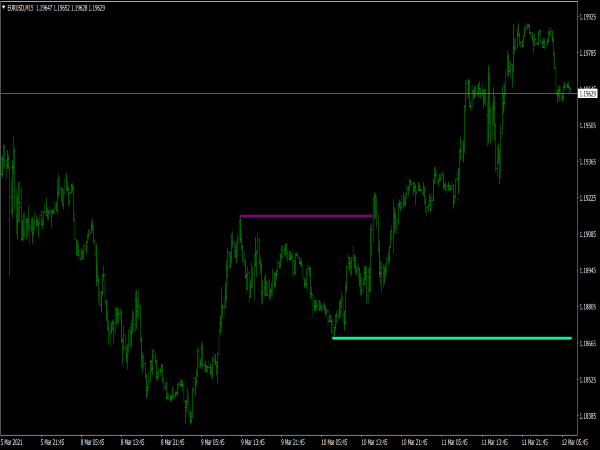

ICT Fair Value Gap Indicator for MT4

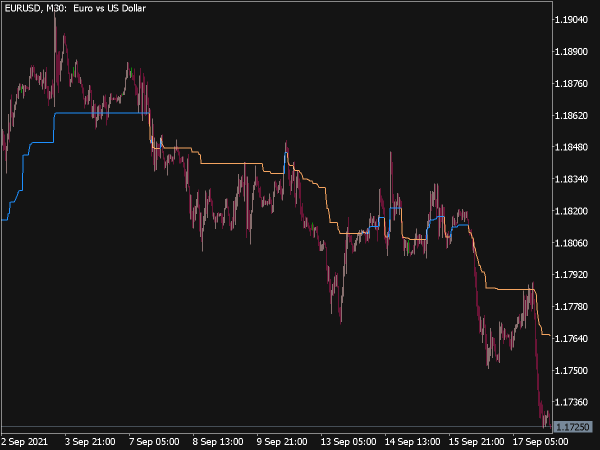

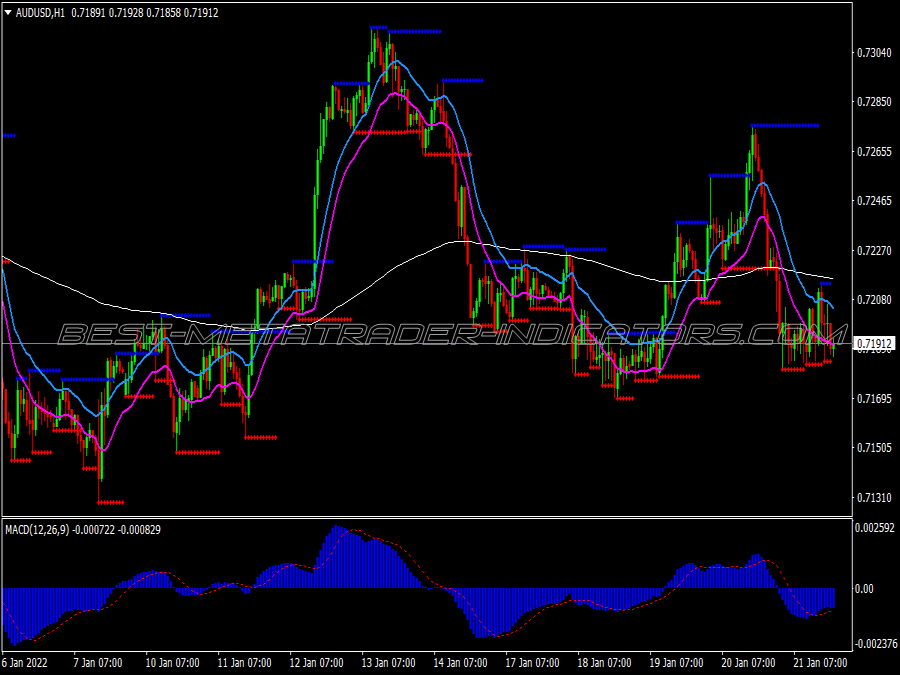

Fair Value Gaps (FVG) Indicator for MT4

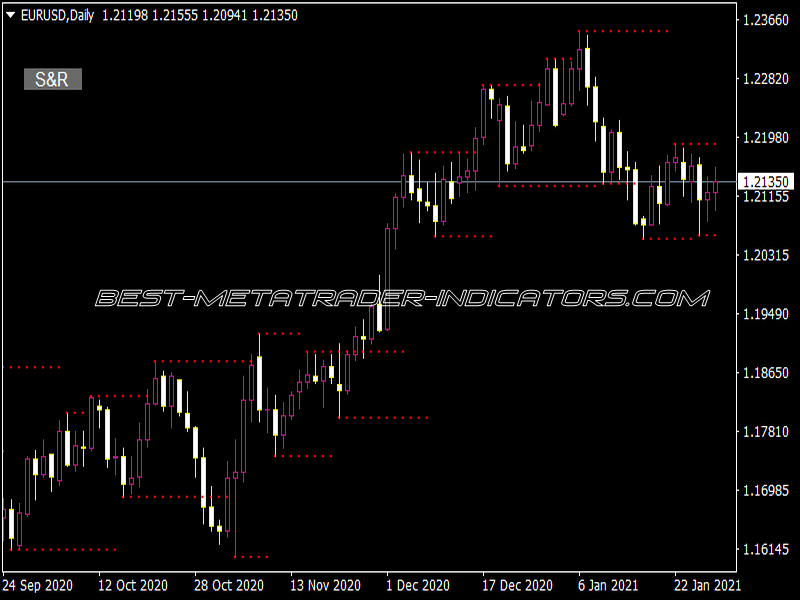

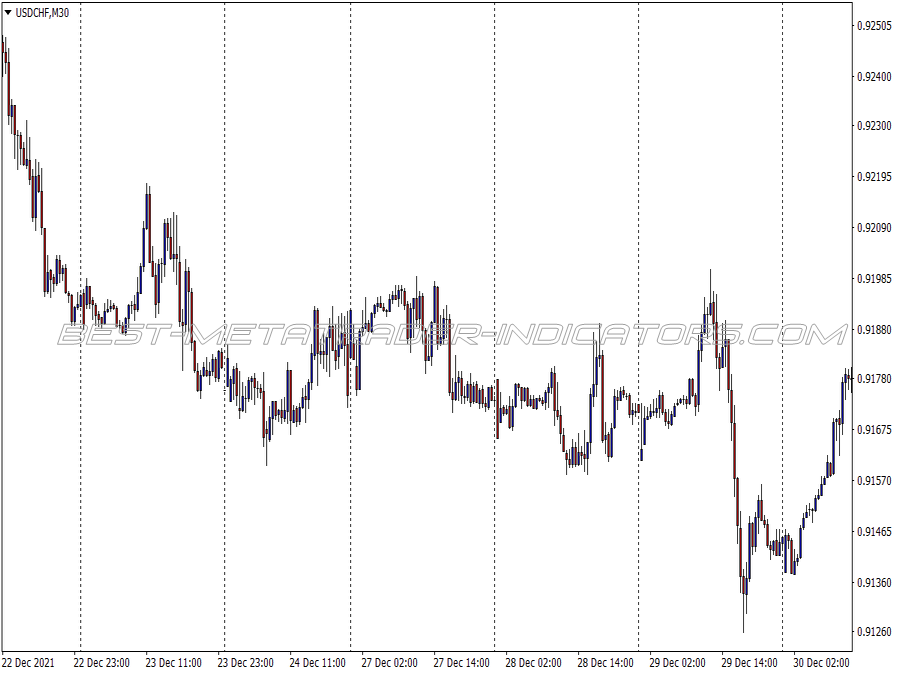

ICT Fair Value Gap Indicator for MT5

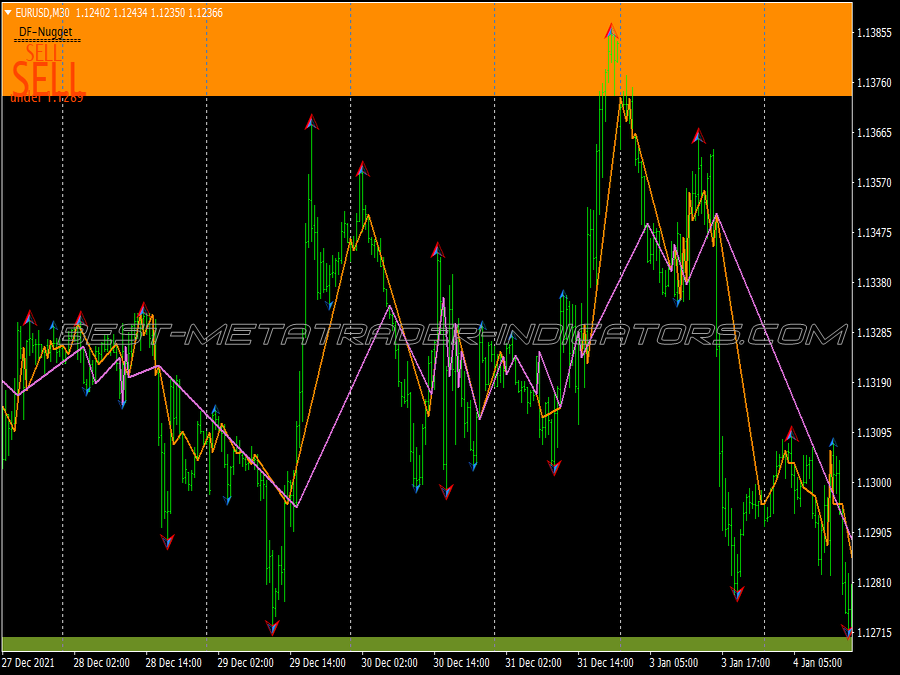

Fair Value Gaps (FVG) Indicator for MT5

Trading Strategies

A Fair Value Gap (FVG) typically appears in a 3-candle formation:

Bullish FVG

- When the low of Candle 3 is higher than the high of Candle 1.

Bearish FVG

- When the high of Candle 3 is lower than the low of Candle 1.

This forms a price “gap” between Candle 1 and Candle 3 that was skipped by the market.

Valid FVG Conditions

- Occurs during strong impulse moves (typically after a large bullish or bearish candle).

- No significant wicks fill the gap immediately (no liquidity taken from that area yet).

- Better if supported by volume spikes or news catalysts.

Entry Strategy

Bullish Fair Value Gap (Buy Setup)

- Wait for price to retrace into the FVG zone (the gap between the high of Candle 1 and the low of Candle 3).

- Enter a long position when:

- Price shows bullish rejection inside the FVG (e.g., bullish engulfing, pin bar).

- There’s a liquidity sweep or inducement just before the FVG touch.

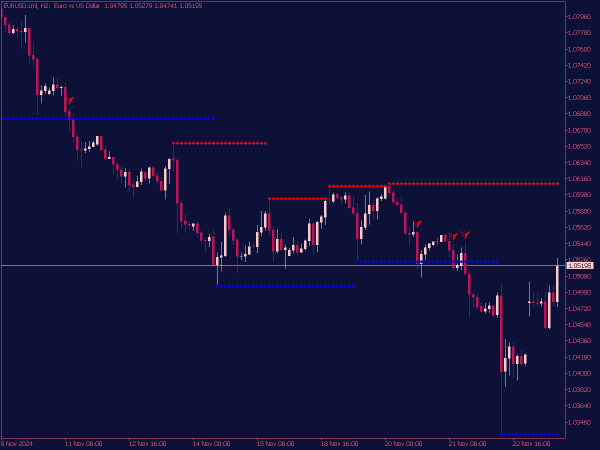

Bearish Fair Value Gap (Sell Setup)

- Wait for price to retrace into the bearish FVG zone.

- Enter a short position when:

- Price shows bearish rejection inside the FVG.

- There’s a liquidity grab before the FVG is tapped.

Stop Loss and Take Profit

Stop Loss

- Place above/below the FVG zone or the recent swing high/low (structure-based).

Take Profit

- First TP at recent market structure levels.

- Second TP at internal liquidity zones or opposing FVGs.

- Consider partial profits at 1:1 or 2:1 RR (risk-reward).

Confirmation Tools (Optional but Useful)

Market Structure

- Use FVGs in alignment with higher timeframe trend.

Order Blocks

- FVGs near order blocks are stronger.

Liquidity Zones

- Look for inducement/liquidity grabs before FVG fills.

Volume Profile

- FVGs near low-volume areas are more likely to be respected.

Avoid FVG Trades When

- The FVG is already partially filled.

- It forms in a choppy or ranging market.

- The gap occurs on low volume or during off-session hours.

- Price is far extended from equilibrium or the higher timeframe mean (e.g., 50 EMA or VWAP).

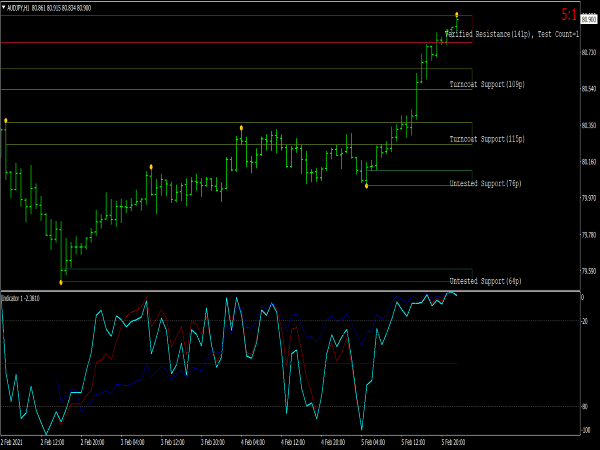

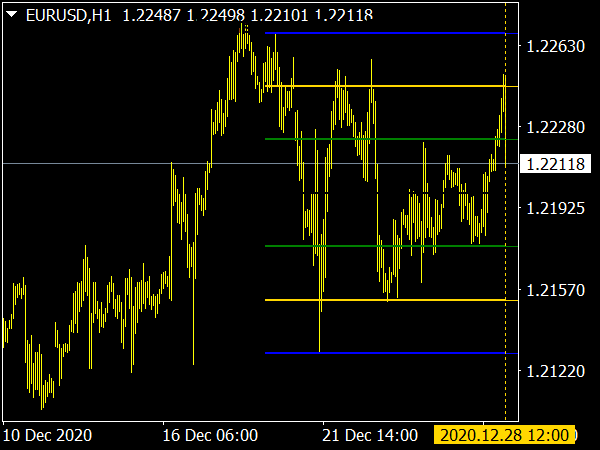

FVG Trading Setup (Bullish Example)

Entry Criteria

- Identify a bullish FVG (formed after an impulsive bullish move).

- Wait for price to retrace into the FVG zone (usually between the open and close of the second candle).

- Look for confluence:

- Previous support/resistance

- Order block in the same area

- Time of day (e.g., NY or London session)

Entry

- Long entry at or near the bottom of the FVG.

- Optional: use a lower timeframe confirmation (e.g., break of market structure or bullish engulfing candle inside FVG).

Stop Loss

- Below the FVG or the swing low before the impulsive move.

Take Profit

- First TP: recent swing high or internal liquidity.

- Second TP: external liquidity (above major highs).

- Use risk-to-reward ratios like 2:1 or 3:1.

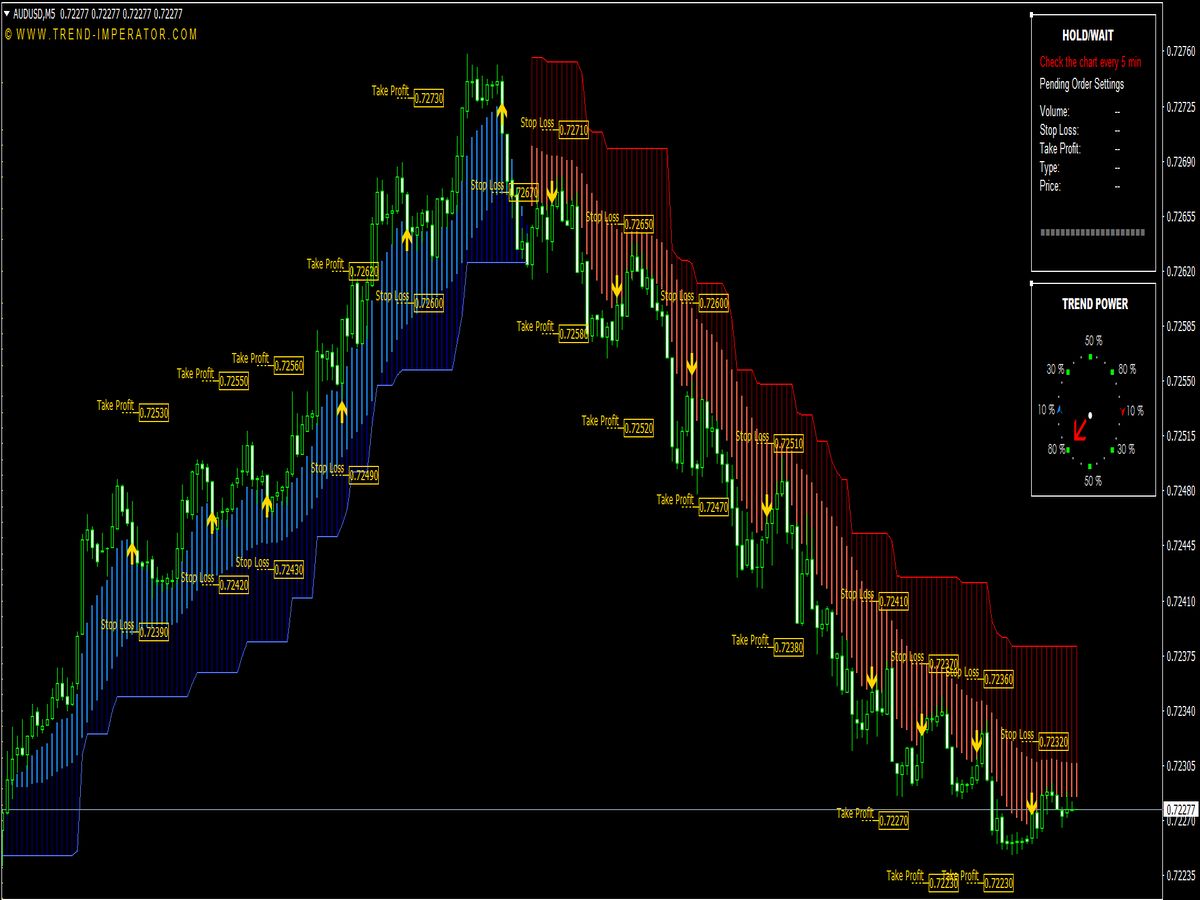

Bearish FVG Setup

The same rules apply in reverse:

- Identify bearish FVG.

- Wait for price to retrace into the FVG.

- Short entry from the top of the FVG.

- SL above FVG or swing high.

- TP at recent swing lows or liquidity pools.

My Tips for Trading FVGs

- Best on 1H, 4H, or daily charts.

- Combine with market structure and liquidity concepts.

- Higher probability during high-volume sessions (e.g., NY open).

- Use multiple time frame analysis for confirmation.