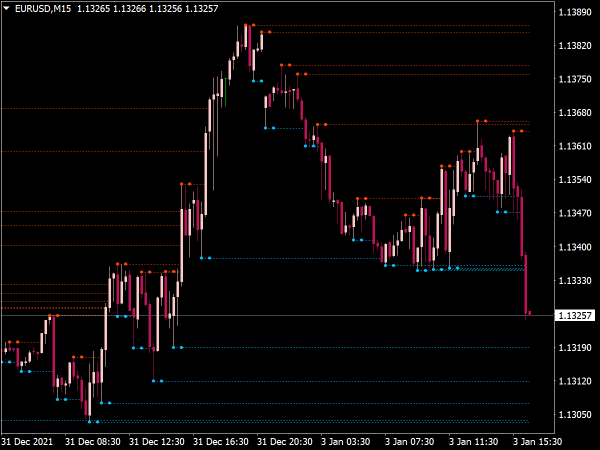

Order block trading is all about identifying and trading based on significant levels of institutional activity. These levels act as zones of support or resistance where the market might reverse or consolidate due to previous large orders from institutions. To trade order blocks successfully, you need to follow a set of rules that guide you through the process.

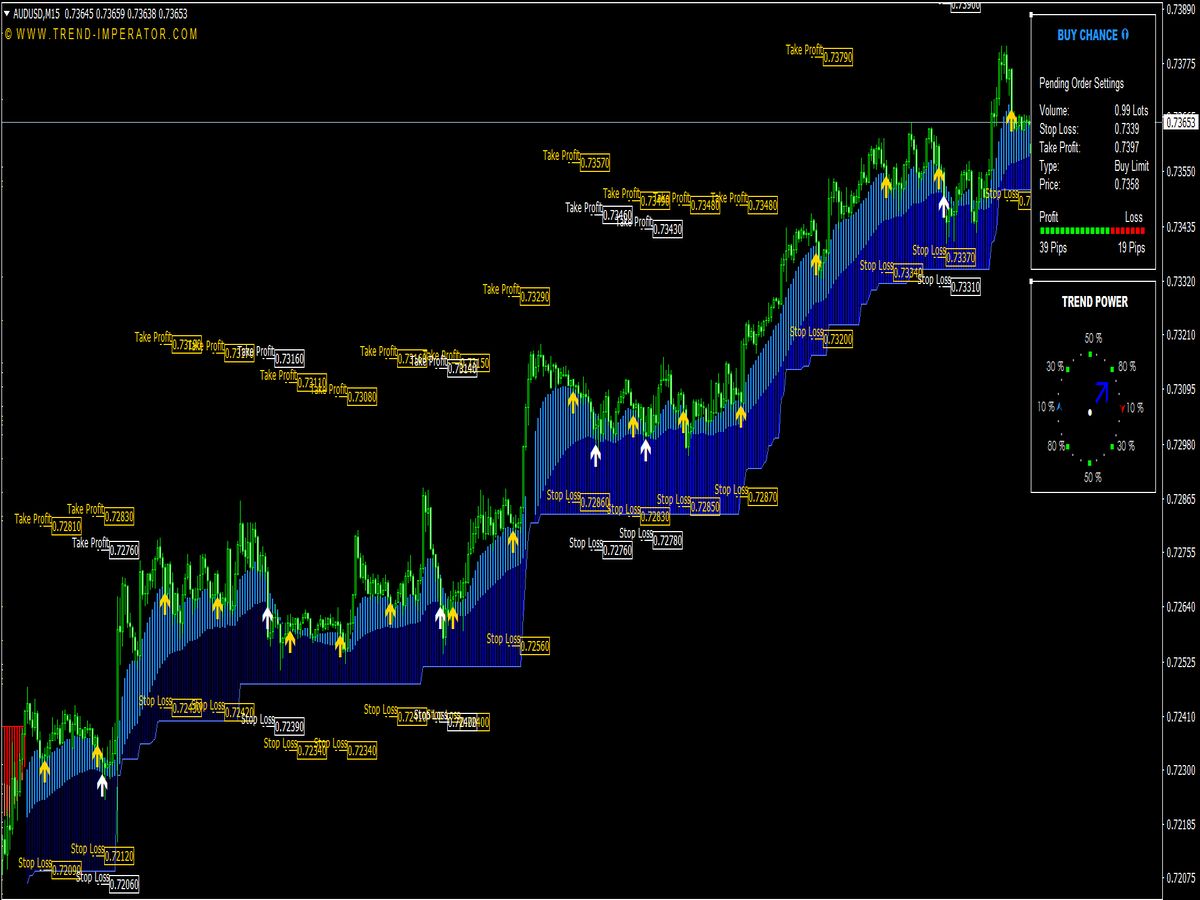

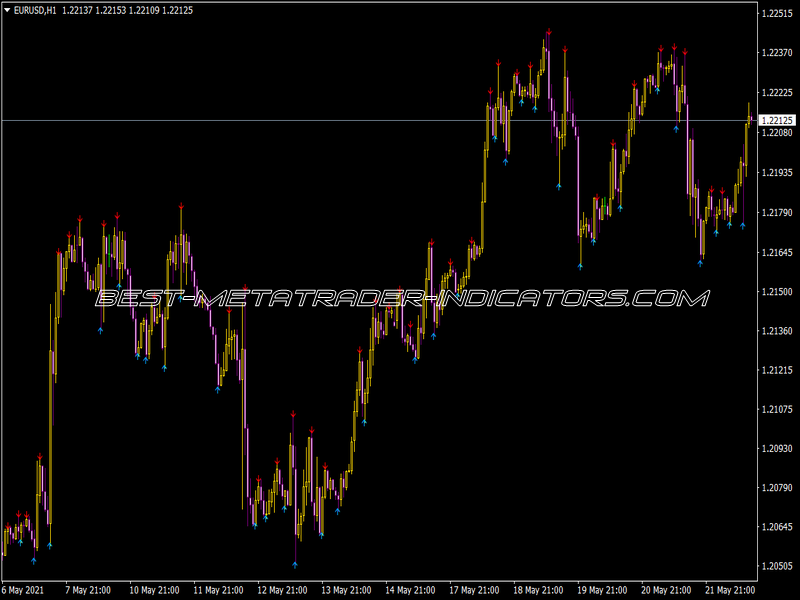

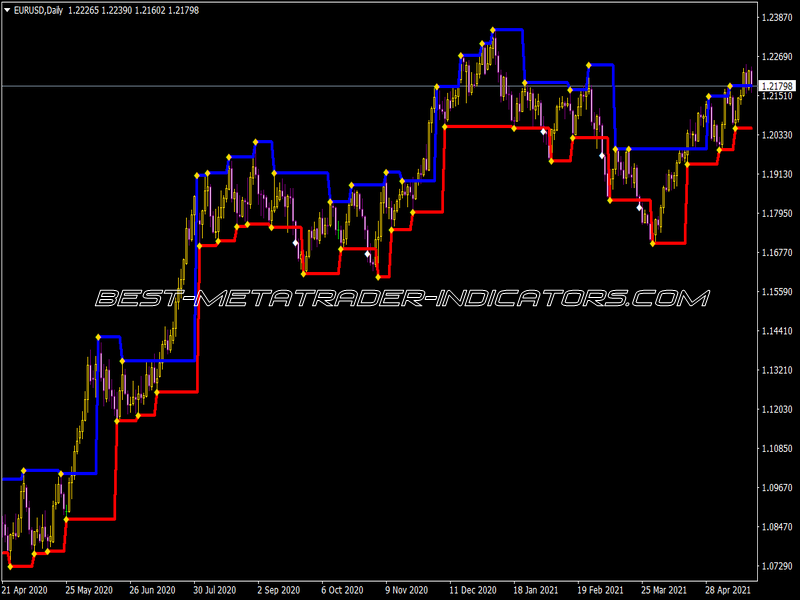

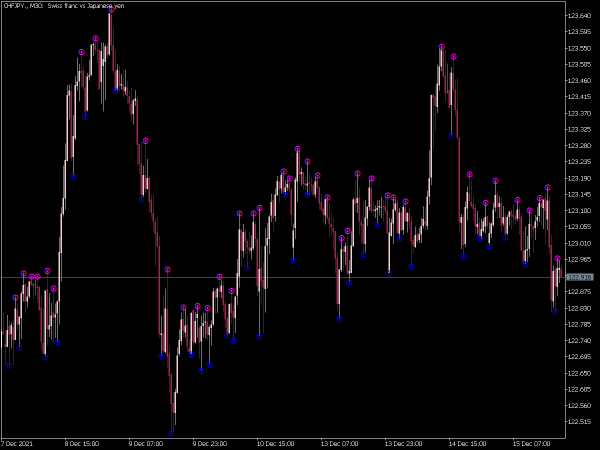

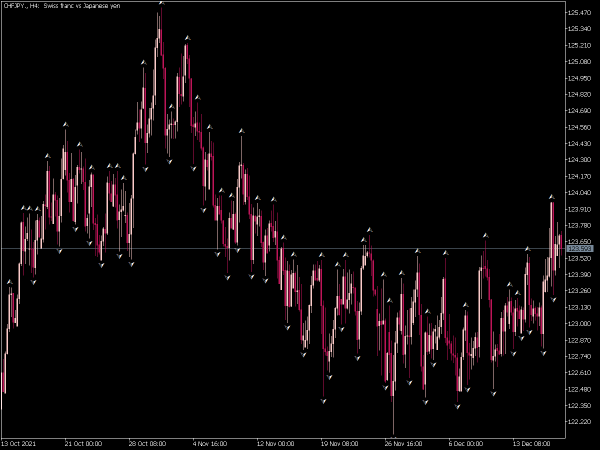

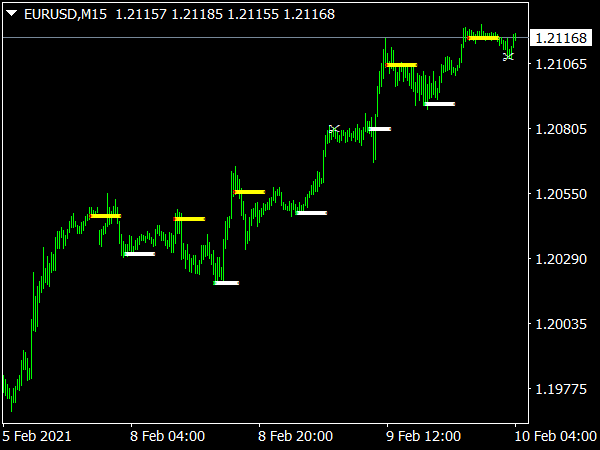

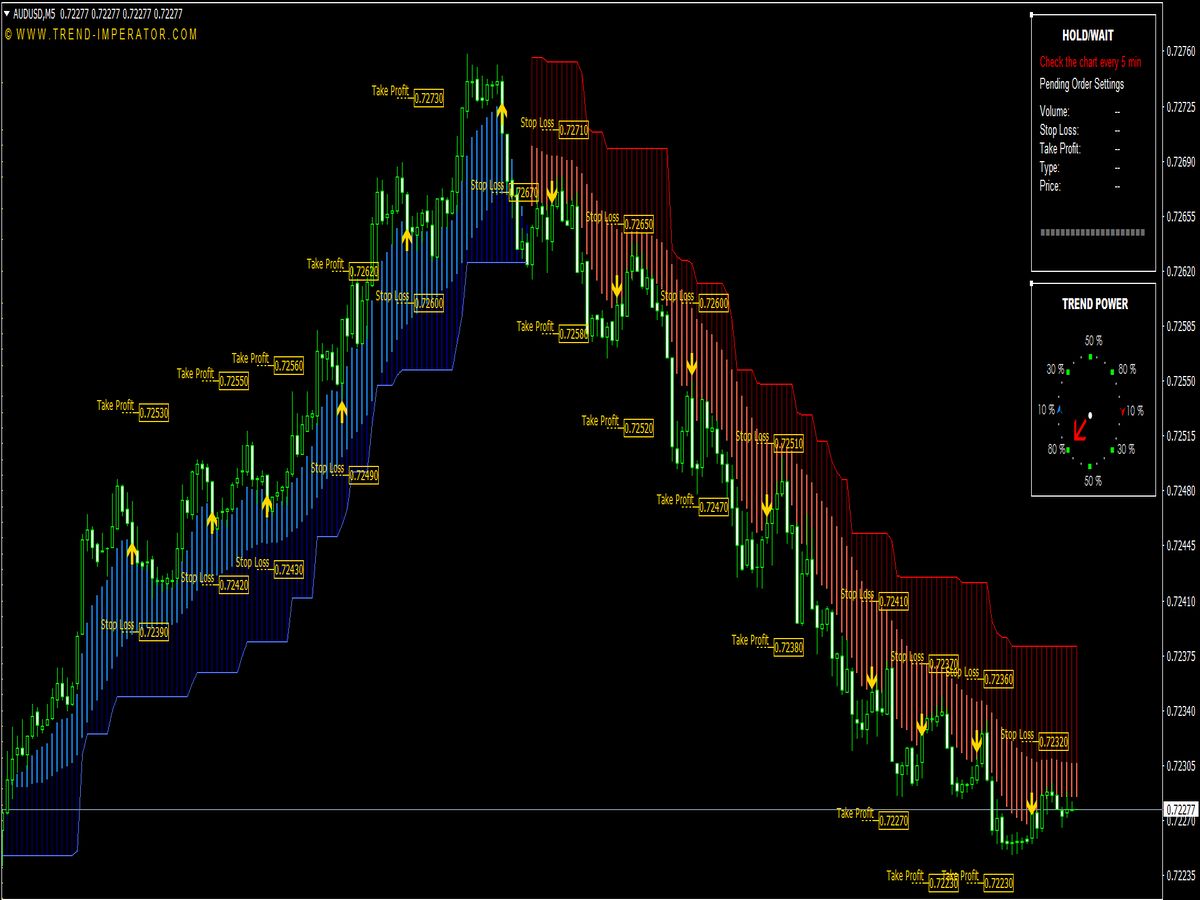

Order Blocks Indicator for MT4

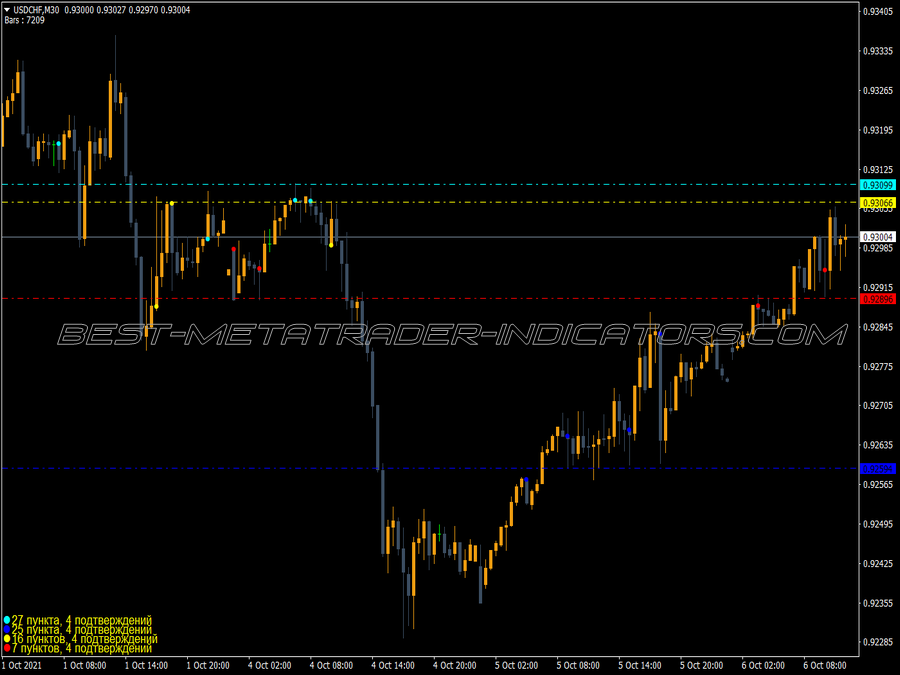

1. Market Structure Analysis

Before you dive into order block trading, it’s essential to first analyze the overall market structure. Is the market trending or range-bound? Is the market in an uptrend or downtrend?

- In an Uptrend:

- Look for bullish order blocks (demand zones).

- In a Downtrend:

- Look for bearish order blocks (supply zones).

A trend provides the context in which order blocks are most effective. Order blocks are more reliable when traded in the direction of the trend.

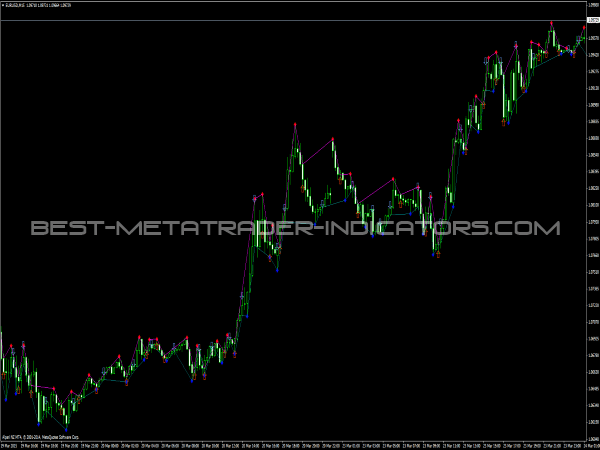

2. Identifying Order Blocks

An order block is the last significant bearish candle before a bullish move or the last bullish candle before a bearish move. These candles indicate where institutions placed large orders.

- Bullish Order Block (Demand Zone):

- The last bearish candle before a strong bullish move.

- This is typically an area where institutions entered the market with large buy orders.

- Bearish Order Block (Supply Zone):

- The last bullish candle before a strong bearish move.

- This is an area where institutions entered the market with large sell orders.

- Look for clear price action:

- The order block should be easily recognizable as the last candle before a strong price movement in the opposite direction.

3. Wait for Price to Retrace to the Order Block

Once you’ve identified a valid order block, wait for the price to retrace back to that level. Order blocks work best when price comes back into the zone for a potential reversal.

- Price must pull back to the order block (not chase the market).

- Look for a retest of the order block where price shows rejection (e.g., candlestick patterns like pin bars or engulfing candles).

- Fibonacci levels can be used as additional confirmation. Price often retraces to 61.8% or 50% Fibonacci of the previous move.

4. Confirmation Signal for Rejection

To enter a trade, look for price action that confirms the market is rejecting the order block. This can be in the form of candlestick patterns, momentum indicators, or break of structure.

- Candlestick Patterns:

- Bullish Order Block: Look for a bullish engulfing pattern, pin bar, or other bullish reversal candlesticks at the demand zone.

- Bearish Order Block: Look for a bearish engulfing pattern, shooting star, or other bearish reversal candlesticks at the supply zone.

- Volume:

- Higher volume near the order block can signal the strength of institutional activity.

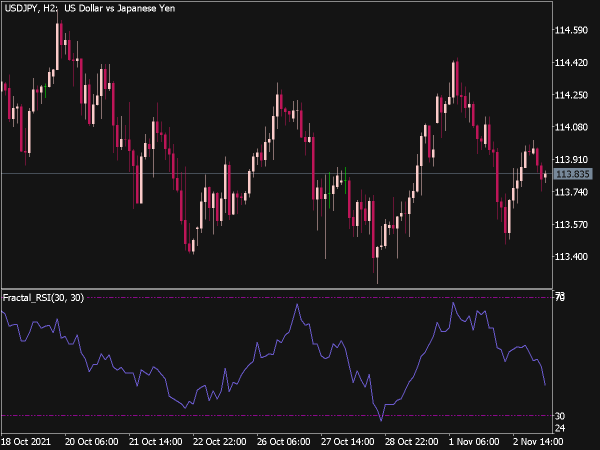

- Momentum Indicators:

- Use tools like RSI (Relative Strength Index) or Stochastic Oscillator to confirm oversold or overbought conditions, suggesting a reversal is likely.

5. Entry Point

Once you’ve confirmed that price has rejected the order block (based on candlestick patterns or other confirmations), you can enter your trade.

- Bullish Order Block:

- Enter long (buy) when price confirms rejection at the bullish order block zone.

- Enter after a bullish candlestick pattern forms, such as an engulfing candle or pin bar.

- Bearish Order Block:

- Enter short (sell) when price confirms rejection at the bearish order block zone.

- Enter after a bearish candlestick pattern forms, such as an engulfing candle or shooting star.

6. Stop Loss and Risk Management

Proper risk management is crucial. Always use a stop-loss and never risk too much on a single trade.

- Bullish Order Block:

- Place your stop loss just below the order block (below the last bearish candle).

- This ensures you’re protected in case the market breaks through the order block.

- Bearish Order Block:

- Place your stop loss just above the order block (above the last bullish candle).

- This helps you avoid losses if the market breaks above the supply zone.

- Risk-Reward Ratio:

- Always aim for a 1:2 or better risk-to-reward ratio.

- If you’re risking 20 pips on a trade, set your take-profit level at least 40 pips away to ensure you’re maximizing potential rewards relative to your risk.

7. Take Profit Targets

Set reasonable take-profit targets based on the market structure, previous price action, or other technical indicators.

- Previous Swing High/Low:

- Use the previous swing high (in a downtrend) or swing low (in an uptrend) as logical take-profit levels.

- Next Order Block:

- The next order block in the direction of your trade can be an excellent target.

- Major Support/Resistance Zones:

- Set take-profit levels at significant support or resistance levels where price has historically reversed.

8. Avoid Overtrading

Order blocks provide high-probability setups, but not every order block will be valid. Avoid overtrading by only taking the highest-quality setups.

- Only trade clear, valid order blocks. Don’t trade every order block you see.

- Ensure that the market is in a clear trend (or a range in the case of support/resistance order blocks).

- Be patient and wait for price confirmation at the order block before entering.

9. Review and Adapt

Constantly evaluate your trades and adapt based on what works. Order block trading is a skill that improves over time, and reviewing your trades will help you understand which setups work best for you.

- Keep a trading journal to track your order block trades and evaluate your success rate.

- Regularly review your strategy and refine your rules as needed based on your experiences and market conditions.

Bullish Order Block Trade Example

- Trend:

- The market is in an uptrend (higher highs and higher lows).

- Identify Order Block:

- Identify the last bearish candle before a sharp upward move.

- Retracement:

- Wait for price to retrace back to this bullish order block zone.

- Confirmation:

- A bullish engulfing candle forms at the order block zone.

- Entry:

- Enter long at the close of the bullish engulfing candle.

- Stop Loss:

- Place the stop-loss just below the order block (below the last bearish candle).

- Take Profit:

- Set a target at the next swing high or the next order block in the direction of the trend.

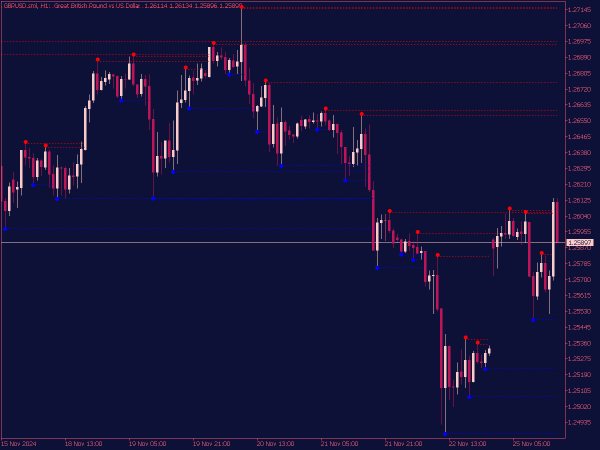

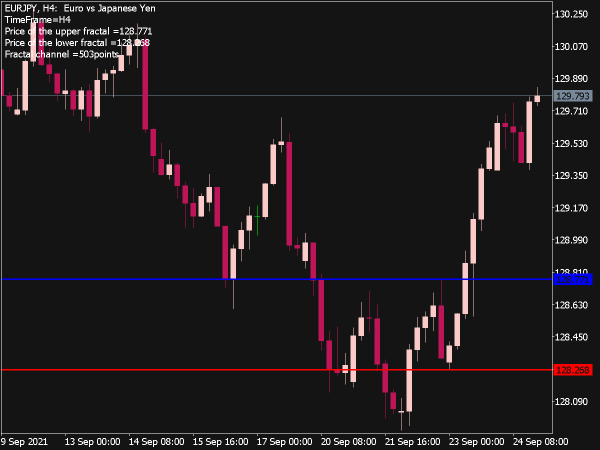

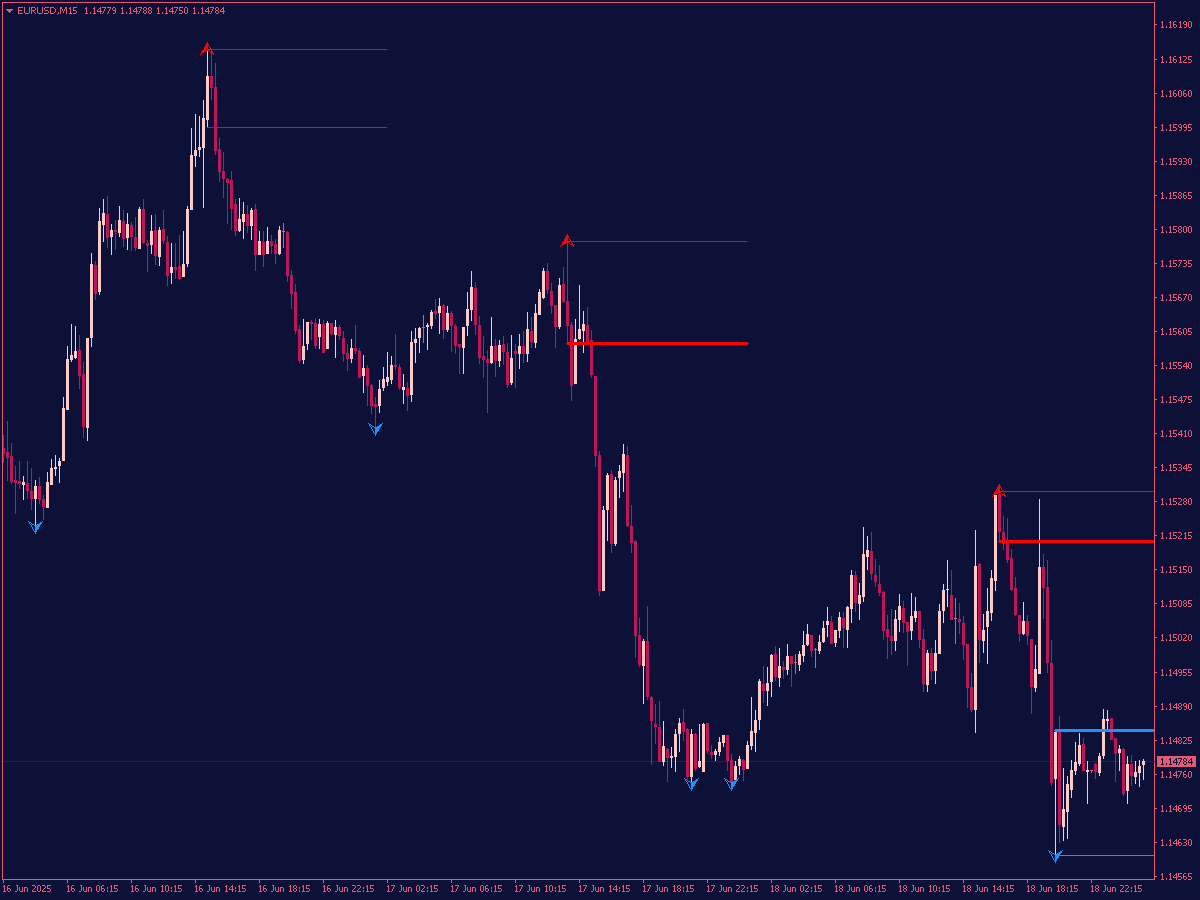

Bearish Order Block Trade Example

- Trend:

- The market is in a downtrend (lower highs and lower lows).

- Identify Order Block:

- Identify the last bullish candle before a sharp downward move.

- Retracement:

- Wait for price to retrace back to this bearish order block zone.

- Confirmation:

- A bearish engulfing candle forms at the order block zone.

- Entry:

- Enter short at the close of the bearish engulfing candle.

- Stop Loss:

- Place the stop-loss just above the order block (above the last bullish candle).

- Take Profit:

- Set a target at the next swing low or the next order block in the direction of the trend.

Final Thoughts

Order block trading is an effective strategy for spotting high-probability trade setups, especially when combined with a strong market structure and confirmation signals. By following these clear rules, you can increase your chances of success and avoid common pitfalls. Always practice sound risk management and continue learning from your trades.