Submit your review | |

Swing trading focuses on capturing short- to medium-term gains in a stock or other financial instrument over a period of a few days to several weeks. Successful entries are crucial for maximizing profit potential. Traders typically look for certain patterns, indicators, and market conditions to identify ideal entry points.

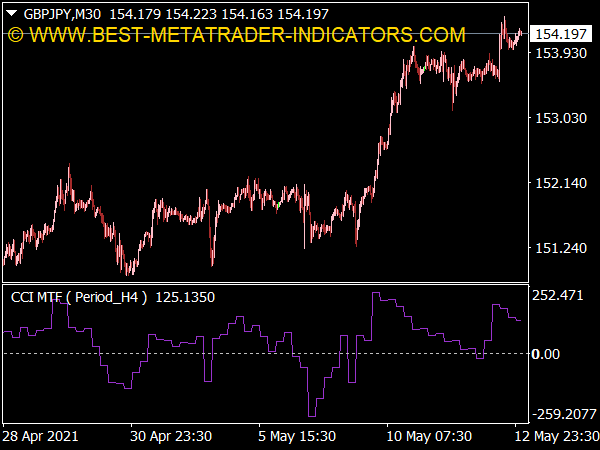

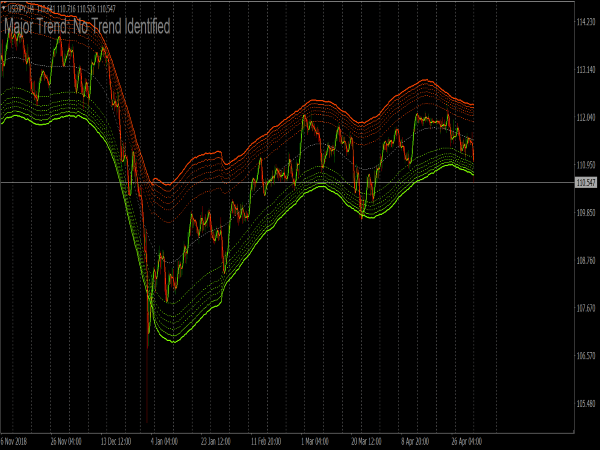

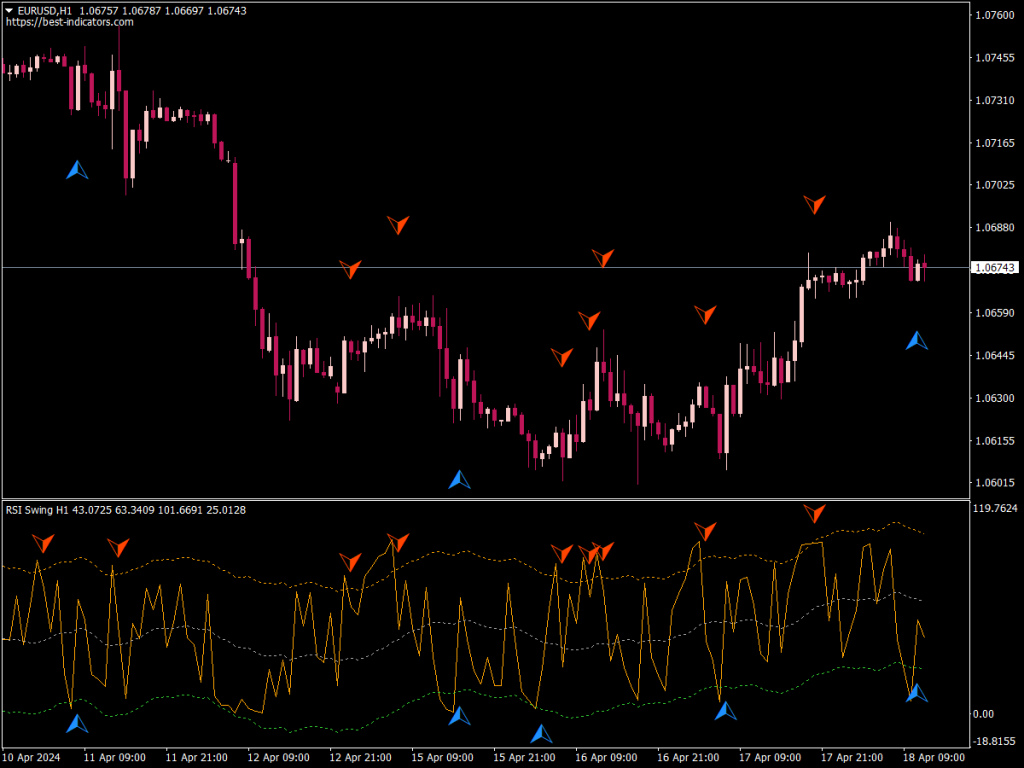

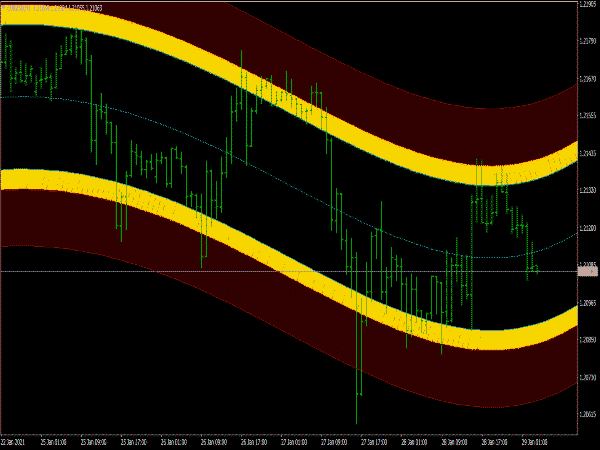

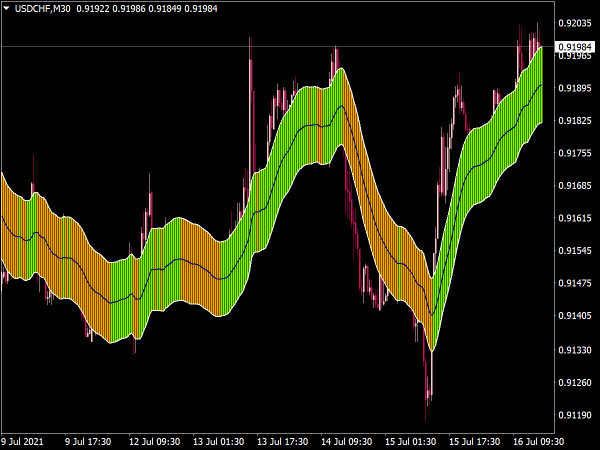

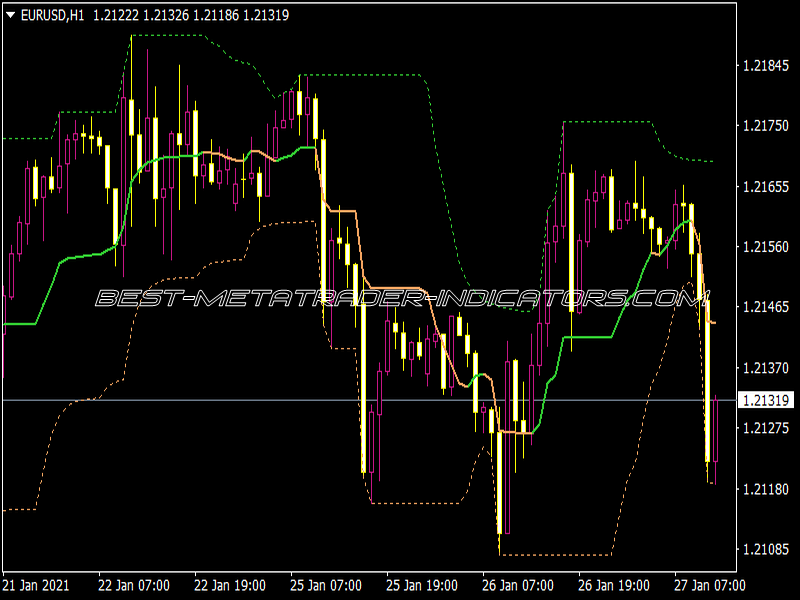

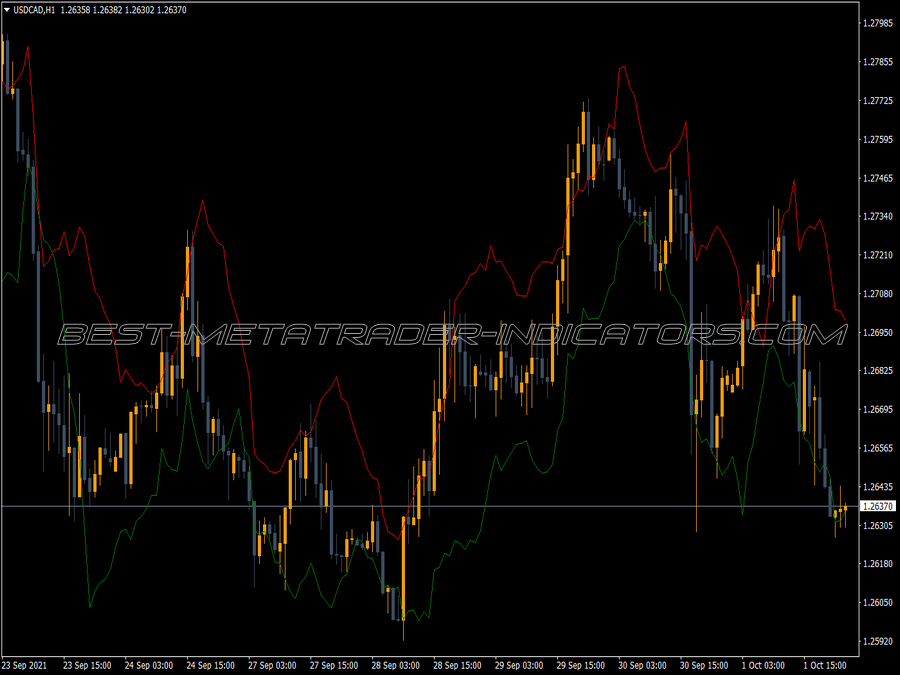

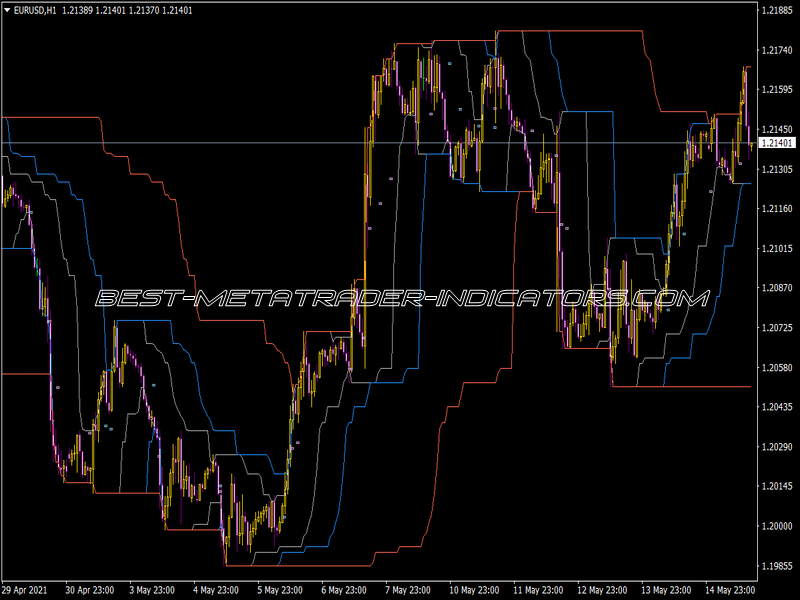

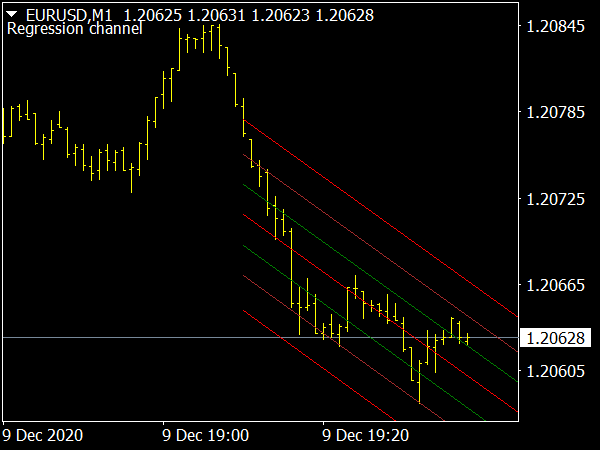

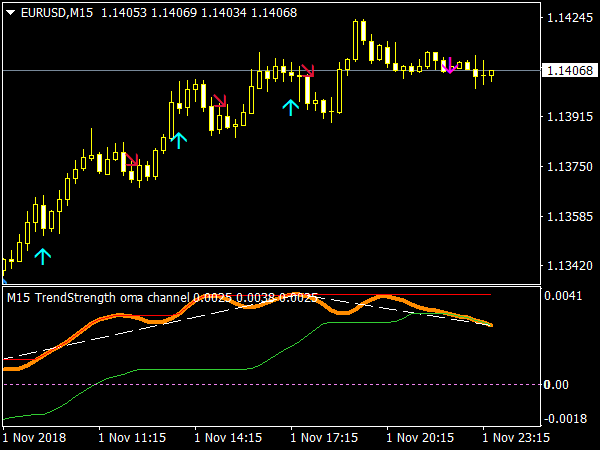

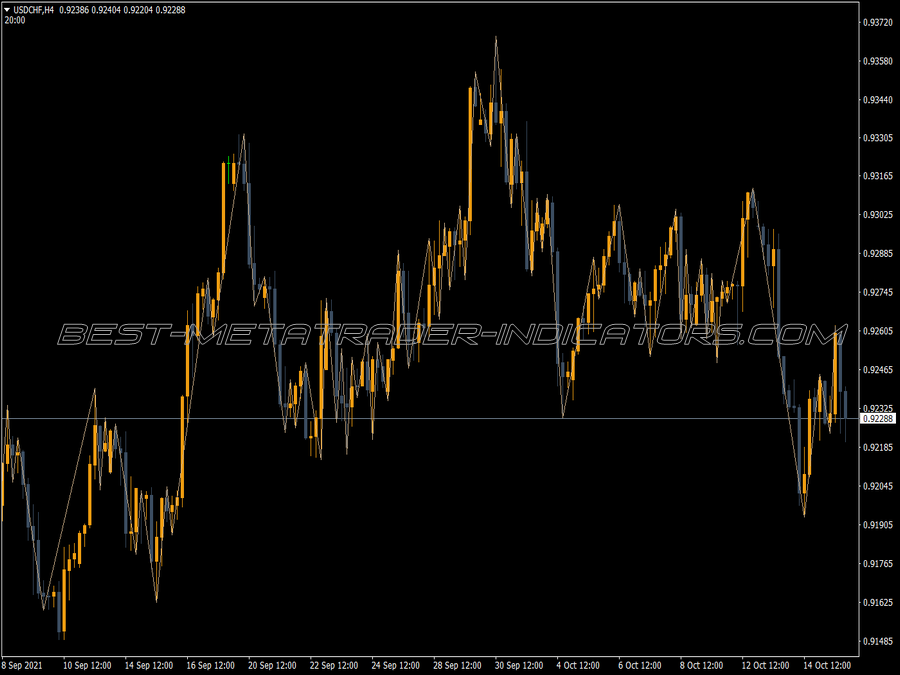

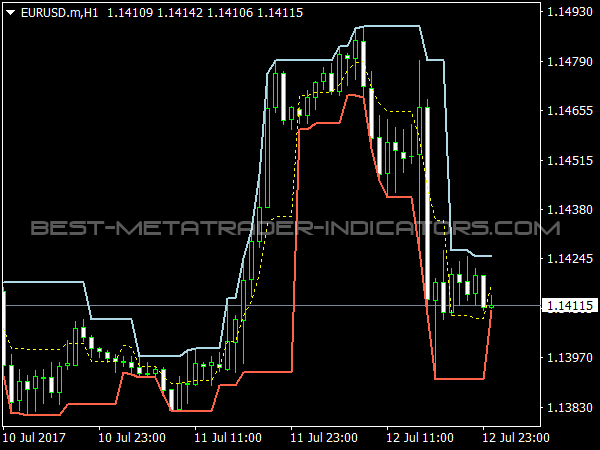

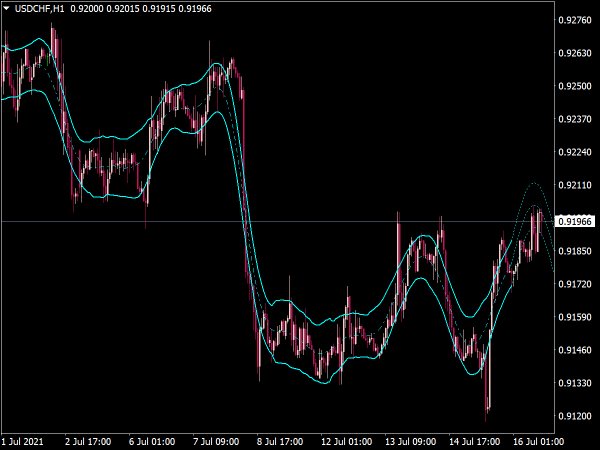

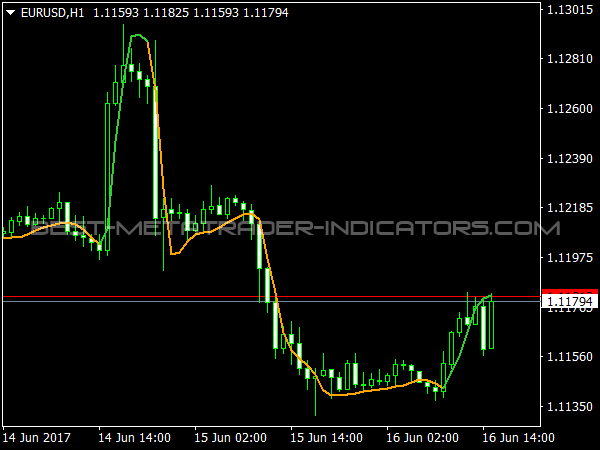

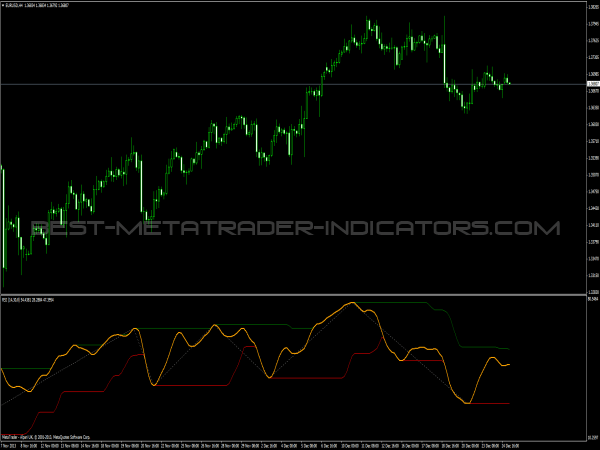

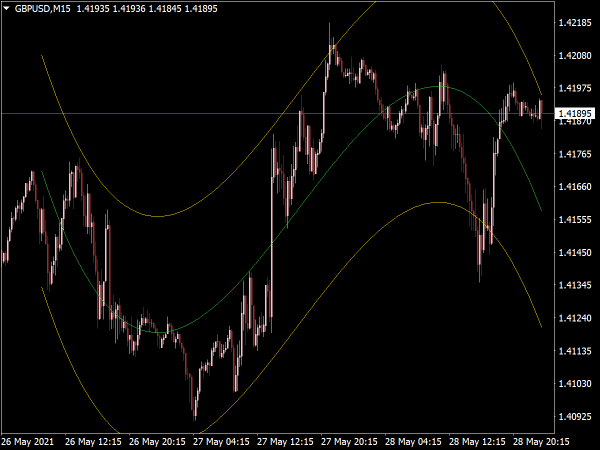

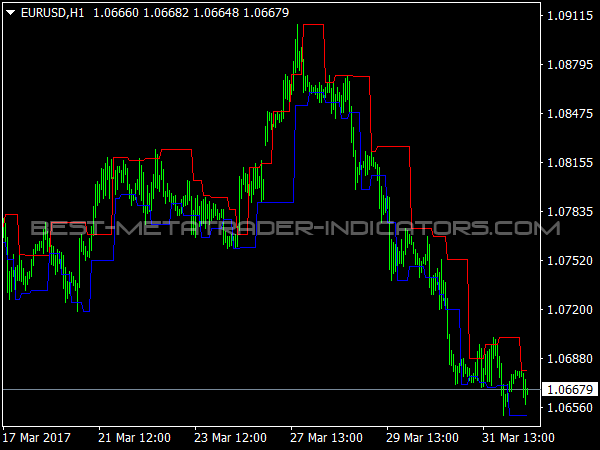

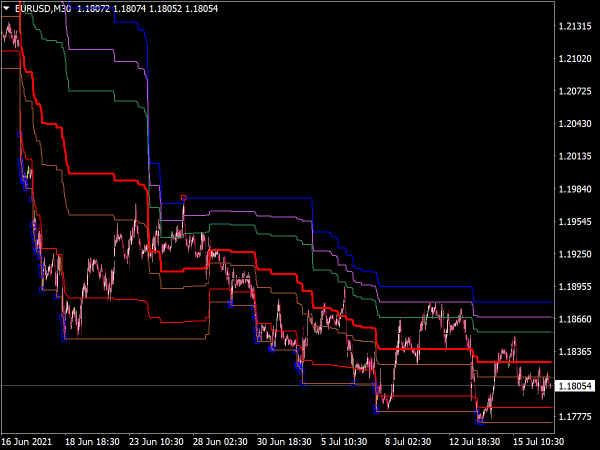

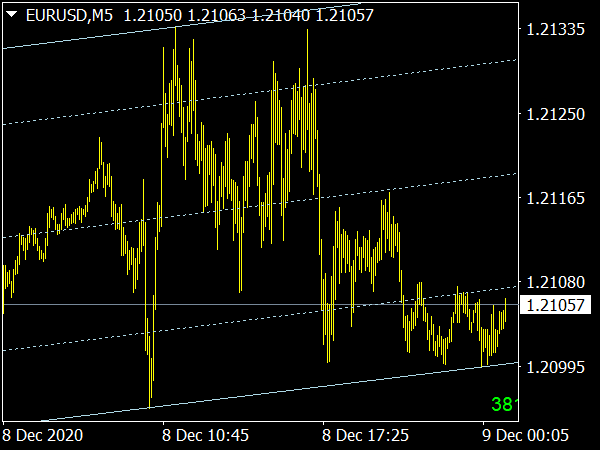

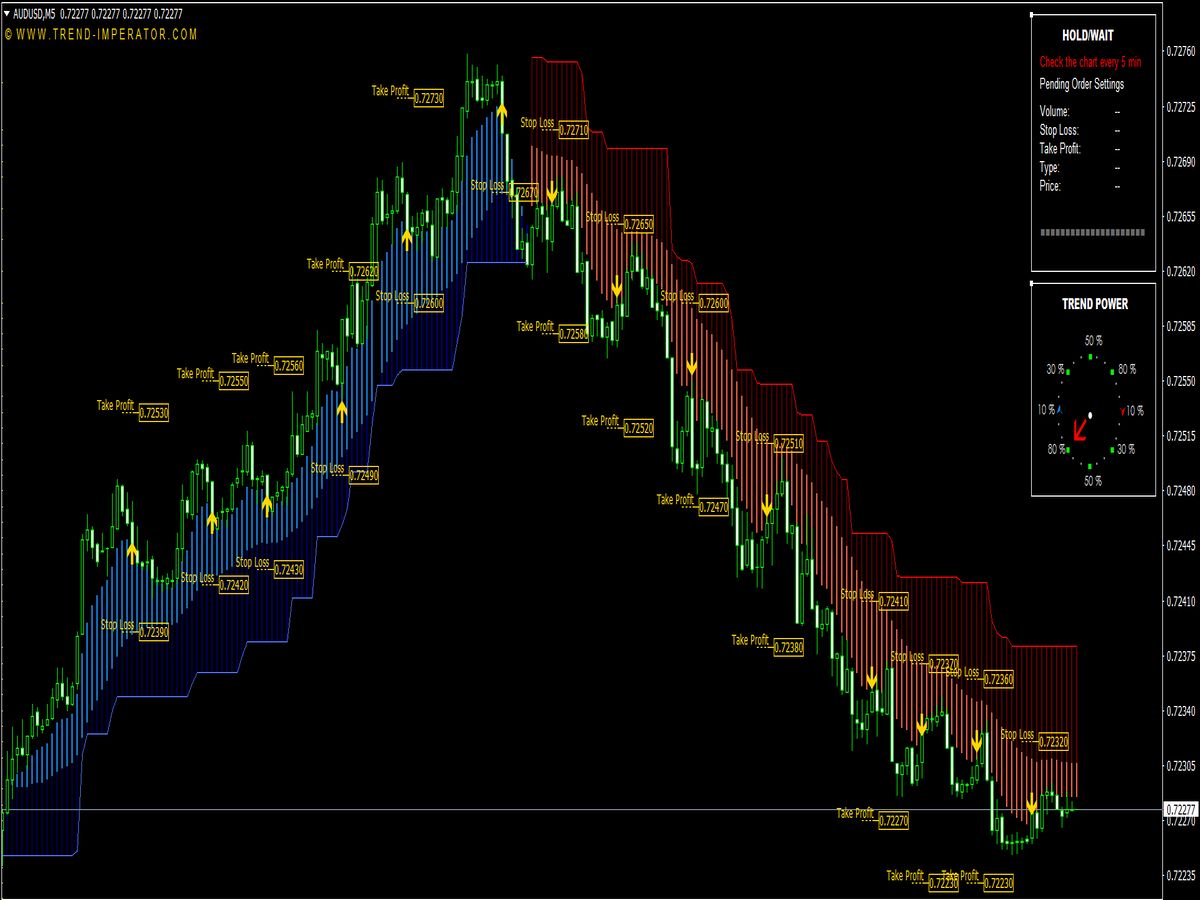

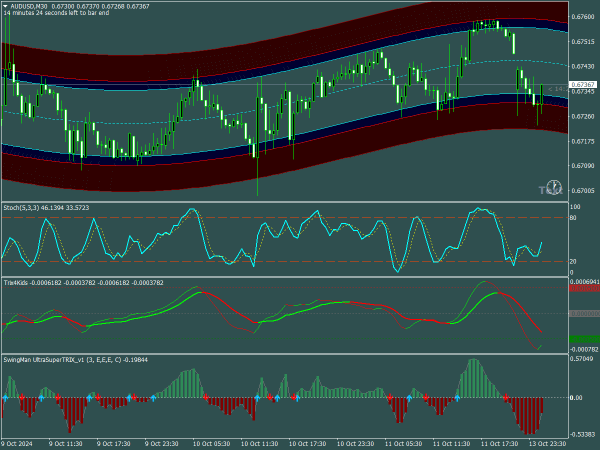

1. Technical Analysis: Swing traders rely heavily on technical analysis. Common indicators include moving averages, Bollinger Bands, Relative Strength Index (RSI), and MACD. For instance, a trader might enter a position when the stock price crosses above its 50-day moving average, indicating bullish momentum.

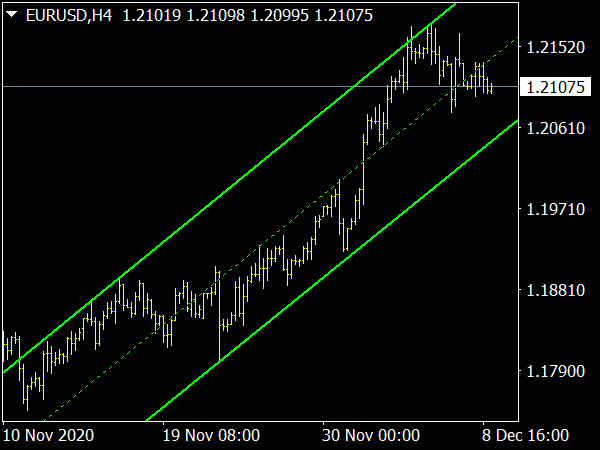

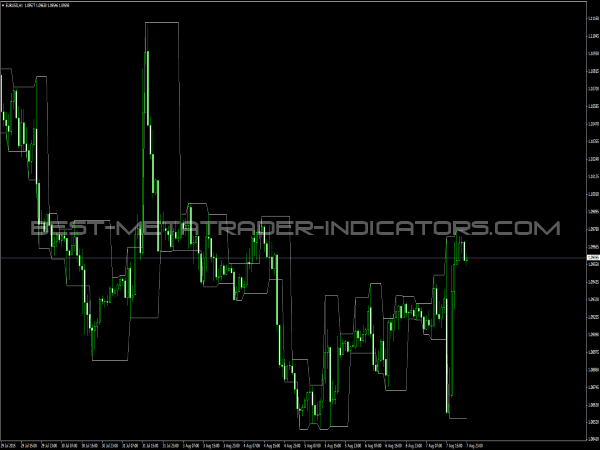

2. Chart Patterns: Recognizing chart patterns, such as head and shoulders, flags, and double bottoms, can present optimal entry points. These patterns signify potential reversals or continuations in trend and help traders make informed decisions.

3. Volume Analysis: Understanding volume trends is vital; a price movement accompanied by rising volume can indicate strength in that movement. Entering trades when volume exceeds the average can enhance the probability of a successful swing.

4. Support and Resistance Levels: Identifying key support and resistance levels can provide critical entry points. A trader may buy near a support level where the stock historically tends to rebound. Conversely, entering a short position near resistance can be prudent.

5. Market News & Events: Earnings reports, economic indicators, and geopolitical events can induce volatility. Swing traders should be aware of these catalysts and may choose to enter trades before or after news announcements, depending on their strategy.

6. Risk Management: Successful entries are not solely about the timing but also about managing risk. Setting stop-loss orders to protect capital ensures that potential losses are mitigated. Determining position size relative to account risk is essential.

In conclusion, swing trading requires a blend of technical tools, market knowledge, and disciplined execution. By honing entry strategies and continuously learning, traders can enhance their chances of success in the dynamic market environment.